The Canada Revenue Agency estimates that $26 billion in federal taxes go uncollected each year. This huge sum shows why knowing about Income Tax Act Offences matters to all Canadian taxpayers.

Canada’s tax system relies on self-assessment. You must report your income accurately and honestly. Failing to do so can lead to penalties or criminal charges.

Section 239 of the Act covers criminal tax evasion offences. Section 238 deals with strict liability violations. The key difference is intent.

Intent determines how severe your penalty might be. It separates administrative errors from deliberate tax fraud.

Understanding these legal limits helps you navigate Canada’s complex tax rules safely. This guide will explain various offences, investigation processes, and ways to stay compliant.

The Canadian Income Tax Act: An Overview

The Income Tax Act is the backbone of Canada’s tax system. It defines obligations for individuals and businesses. This legislation also establishes consequences for non-compliance.

Knowing the system’s history helps explain why certainIncome Tax Act offencesare treated severely today.

Historical Development of Tax Legislation in Canada

Canada’s tax approach has changed greatly since the nation’s founding. It now reflects evolving economic needs and governance philosophies.

Evolution of Tax Laws Since Confederation

In 1867, Canada’s federal government relied mainly on customs duties and excise taxes. Direct taxation came later as a “temporary” measure to fund World War I.

The Income War Tax Act of 1917 was Canada’s first federal income tax law. This wartime necessity became a permanent part of Canadian fiscal policy.

The modernIncome Tax Actemerged in 1971, following recommendations from the Royal Commission on Taxation. It established many principles that still guide Canadian tax administration today.

Modern Tax Administration Structure

Today’s tax system uses a sophisticated framework to ensure compliance and provide services. The Department of Finance develops tax policy. The Canada Revenue Agency handles implementation and enforcement.

The current structure emphasizes service and enforcement. Digital filing systems make compliance easier. Sophisticated audit programs identify potentialtax fraudcases.

Key Authorities: Canada Revenue Agency (CRA) and Their Powers

The Canada Revenue Agency (CRA) administers and enforces tax laws across the country. Established in 1999, the CRA operates with considerable autonomy and extensive legal powers.

The agency’s role goes beyond tax collection. It includes benefit distribution, international tax agreements, and enforcing tax-related statutes.

Enforcement Capabilities Under Federal Law

The CRA has strong enforcement tools to ensure tax compliance. These powers have grown as the government prioritizes fighting tax evasion and fraud.

The CRA’s Criminal Investigations Program targets significant cases of tax evasion andtax fraud. Serious cases may be referred for criminal prosecution.

Enforcement capabilities include:

| Enforcement Power | Description | Legal Authority | Potential Consequences |

|---|---|---|---|

| Audit Authority | Examination of financial records and tax filings | Income Tax Act, Section 231.1 | Reassessments, penalties, interest charges |

| Search and Seizure | Legal authority to obtain warrants and seize evidence | Income Tax Act, Section 231.3 | Collection of evidence for prosecution |

| Requirement Orders | Compelling production of documents or information | Income Tax Act, Section 231.2 | Penalties for non-compliance |

| Criminal Investigation | Full investigation of suspected tax crimes | Income Tax Act, Section 239 | Criminal charges, fines, imprisonment |

These enforcement tools show the government’s commitment to maintaining tax system integrity. The CRA can impose hefty penalties for non-compliance.

Serious tax evasion cases may lead to criminal prosecution, large fines, and imprisonment. Understanding this framework highlights the gravity ofIncome Tax Act offences.

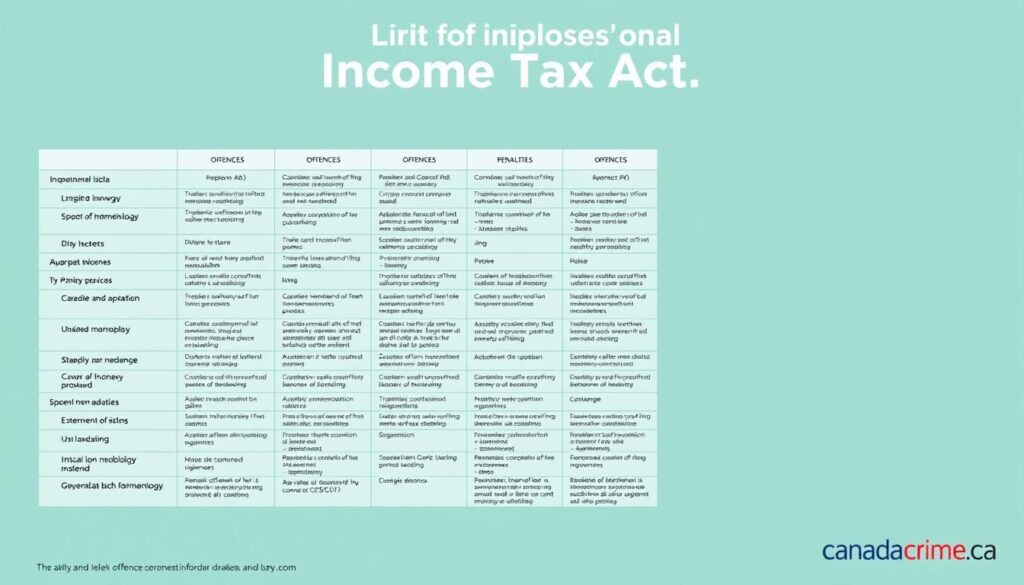

Income Tax Act Offences: Classification and Categories

Canadian Income Tax Act offences are sorted by severity, intent, and procedural impact. Knowing these groups helps taxpayers understand compliance risks and consequences. The tax enforcement system uses a scale based on violation seriousness.

The Act separates civil and criminal violations. Civil violations involve administrative non-compliance issues. These are serious but don’t usually involve deliberate fraud attempts.

Criminal tax violations involve intentional wrongdoing with severe consequences, including possible jail time. These are prosecuted under Section 239. They require proof of deliberate misconduct.

| Aspect | Civil Tax Violations | Criminal Tax Violations |

|---|---|---|

| Legal Nature | Administrative/Regulatory | True Criminal Offences |

| Intent Requirement | Strict Liability (No intent needed) | Mens Rea (Guilty mind) Required |

| Primary Penalties | Monetary Penalties, Interest | Fines, Imprisonment, Criminal Record |

| Governing Section | Primarily Section 238(1) | Primarily Section 239(1) |

Burden of Proof Differences

A fundamental distinction between civil and criminal tax cases is the required proof burden. For civil violations, the CRA must prove facts on a “balance of probabilities” standard.

This means the alleged violation is more likely to have occurred than not. Criminal tax prosecutions need “proof beyond a reasonable doubt.”

This higher standard reflects the serious nature of criminal charges and their potential life-changing effects.

Most Frequently Prosecuted Tax Offences in Canada

The Income Tax Act has many offence provisions. However, some violations get more enforcement attention. The most commonly prosecuted offences include:

- Deliberate tax evasion through concealment of income

- Filing false tax returns with intentional misrepresentations

- Claiming fraudulent deductions or credits

- Persistent failure to file returns despite requirements

- Participation in tax schemes designed to fraudulently reduce tax liability

Statistical Trends in Tax Prosecution

CRA enforcement data shows changing patterns in tax prosecution. Recent years focus more on offshore non-compliance, complex tax schemes, and electronic fraud. The CRA is watching industries with higher non-compliance rates more closely.

These include construction, hospitality, and some cash-heavy businesses. Prosecution stats show that while case numbers vary yearly, average penalties have increased. This reflects a tougher approach to serious tax offences.

The CRA’s criminal investigations usually target cases with large tax amounts or particularly bad conduct.

Tax Evasion: Deliberate Non-Compliance

Tax evasion is a serious offense defined in Section 239 of the Income Tax Act. It involves deliberately defrauding the Canadian tax system through deceptive practices. This offense carries hefty penalties that can severely impact your finances and freedom.

Defining Tax Evasion Under Section 239 of the Income Tax Act

Tax evasion occurs when you knowingly reduce or eliminate tax obligations illegally. The Canada Revenue Agency (CRA) identifies several common forms of tax evasion.

- Deliberately failing to report income

- Falsifying records and documentation

- Claiming fictitious or inflated expenses

- Creating false invoices or receipts

- Submitting fraudulent claims for tax credits or benefits

Intent Requirements for Criminal Prosecution

For criminal charges, the CRA must prove you acted with willful intent to deceive tax authorities. This goes beyond simple errors or negligence.

Evidence of intent includes behavior patterns, concealment efforts, and inconsistencies between reported and actual financial activities.

Distinction Between Tax Avoidance and Tax Evasion

Tax avoidance involves legal strategies to minimize your tax burden through legitimate means. This includes claiming eligible deductions or structuring affairs efficiently.

Tax evasion becomes illegal when you deliberately misrepresent information or conceal facts from the CRA. The line between the two can be blurry, making professional tax advice valuable.

Recent Canadian Court Rulings

Canadian courts have upheld severe penalties for tax evasion. Recent cases saw fines up to 200% of evaded taxes plus jail terms of five years.

The 2018 R v. Stanchfield case showed that even sophisticated tax planning can be evasion if misrepresentation occurs. The 2020 Cameco Corporation case emphasized courts’ focus on deceptive intent in criminal evasion.

Filing False or Misleading Tax Returns

Filing incorrect tax returns is a serious violation of Canada’s tax laws. Section 239(1)(a) of the Income Tax Act prohibits false statements in tax documents. Submitting inaccurate information to the CRA can lead to hefty penalties and criminal charges.

Elements of False Statement Offences

The CRA must prove several elements for a false statement offence. The statement must be untrue or misleading. It must also be material to determining your tax liability.

Lastly, there must be evidence of intent or willful blindness. This means you knew the information was false or avoided verifying its accuracy.

Material Omissions vs. Active Misrepresentations

False statement offences fall into two main categories. Material omissions occur when you fail to report required information. This includes unreported income or undisclosed foreign assets.

Active misrepresentations involve providing incorrect information on tax returns. Examples include falsifying documents or mischaracterizing personal expenses as business deductions.

Common Examples of Tax Return Misrepresentation

The CRA often encounters various forms of tax return misrepresentation. These include underreporting income, claiming fake business losses, and exaggerating charitable donations. Data analytics help identify suspicious patterns that may trigger investigations.

Falsified Expenses and Credits

A common form of tax fraud involves falsifying expenses and credits. This includes claiming personal expenses as business deductions, like reporting family vacations as business trips.

Another violation is manipulating eligibility criteria for tax credits. Examples include falsely claiming dependents or fabricating education expenses. Misrepresenting principal residence status to claim undeserved exemptions is also common.

Failure to File Income Tax Returns

Filing income tax returns in Canada comes with strict deadlines and rules. Not following these can lead to big penalties. Subsection 238(1) of the Income Tax Act outlines the consequences of failing to file.

All Canadian taxpayers must understand these rules. Knowing your obligations can help you avoid costly mistakes and legal troubles.

Legal Requirements and Filing Deadlines

The Canada Revenue Agency (CRA) sets clear filing deadlines. Most people must file by April 30th of the year after the tax year.

Self-employed individuals and their spouses have until June 15th to file. However, any taxes owed are still due by April 30th.

Filing on time helps you avoid late-filing penalties, even if you can’t pay right away. The CRA may grant extensions in special cases like natural disasters or serious illness.

Individual vs. Corporate Filing Obligations

Individual and corporate taxpayers have different filing rules under Canadian tax law:

| Aspect | Individual Taxpayers | Corporate Taxpayers |

|---|---|---|

| Filing Deadline | April 30th (June 15th for self-employed) | Six months after fiscal year-end |

| Required Forms | T1 General | T2 Corporation Income Tax Return |

| Payment Deadline | April 30th regardless of filing date | Two months after fiscal year-end (three for CCPCs) |

| Filing Method | Electronic or paper | Mandatory electronic filing for most |

Repeated Non-Compliance Consequences

The CRA takes steps when taxpayers repeatedly fail to file returns. They start with reminder notices and phone calls.

If non-compliance continues, the CRA may send formal demands to file. Ignoring these can result in additional penalties.

In serious cases, the CRA might pursue criminal charges. This can happen if there’s evidence of willful non-compliance or deliberate tax avoidance.

Escalating Penalty Structure

Penalties for not filing taxes increase with repeated or long-term non-compliance:

- Late-filing penalty: 5% of unpaid tax plus 1% per month (up to 12 months)

- Repeated late-filing: 10% of unpaid tax plus 2% per month if previously penalized in the last three years

- Failure to file after formal demand: Additional penalty of up to $1,000

- Summary conviction: Fines between $1,000 and $25,000, possible imprisonment up to 12 months

These penalties can add up quickly. It’s crucial to file your taxes on time to avoid serious financial and legal problems.

Underreporting Income and Revenue Concealment

Revenue concealment and income underreporting are big problems for Canadian tax authorities. They use advanced methods to catch tax cheats. Purposely not reporting income is tax evasion under the Income Tax Act. It can lead to fines and jail time.

The CRA has special ways to find differences between reported and actual income. They focus on certain business types that often break tax rules.

Cash Business Compliance Issues

Cash-heavy businesses are hard for tax authorities to check. These businesses must keep careful records to show they follow tax laws. Without good records, they risk audits and accusations of hiding income.

The CRA watches industries known for tax cheating closely. These include restaurants, construction, retail, and personal services. These businesses often use cash and tend to underreport income.

The CRA uses special audit methods for these industries. They compare purchase records to reported sales. They also make surprise visits to check on businesses.

Unreported Foreign Income

Canadian residents must report all income, no matter where it’s earned. Not reporting foreign income is serious tax evasion. The CRA pays close attention to this issue.

The Foreign Income Verification Statement (T1135) is required for some taxpayers. Those with foreign assets over $100,000 must give details about these holdings.

International Information Exchange Agreements

Offshore tax compliance has changed a lot due to international teamwork. The CRA shares information with tax authorities worldwide to fight unreported foreign income.

The Common Reporting Standard (CRS) and FATCA allow automatic sharing of financial account info. These agreements make it harder to hide offshore assets and income.

It’s now much more likely that international tax evasion will be caught. The CRA has powerful tools to find hidden money abroad.

Offshore Tax Havens and Money Laundering Concerns

Offshore tax havens pose big problems for Canada’s tax system. These places offer low taxes and keep financial secrets. They attract both legal businesses and those hiding money from tax collectors.

Canada’s International Tax Enforcement Efforts

Canada has stepped up its fight against offshore tax cheating. The Canada Revenue Agency (CRA) has special teams using advanced tools to find tax dodgers.

These teams work with global partners to tackle tax avoidance. They join forces on big investigations when major financial secrets are leaked.

The Common Reporting Standard Implementation

Canada’s key weapon is the Common Reporting Standard (CRS). Started in 2017, it helps countries share financial info automatically.

Canadian banks must report foreign-owned accounts to the CRA. This info is then shared with other countries, making it harder to hide money offshore.

Voluntary Disclosure Options for Offshore Assets

If you have hidden offshore assets, the CRA’s Voluntary Disclosures Program (VDP) might help. It lets people fix old tax returns without facing full penalties.

Limitations and Eligibility Requirements

Recent changes have made it harder to use the VDP, especially for rich people with offshore accounts. To qualify, your disclosure must meet certain rules.

- Voluntary (not prompted by CRA enforcement actions)

- Complete (all relevant information provided)

- Involve potential penalties or prosecution

- Include information at least one year past due

The program now offers less help for big tax cheats. This includes cases with lots of money or offshore assets.

Talk to a tax expert before using the VDP. They can explain the current rules and possible outcomes.

Tax Avoidance Schemes and Artificial Transactions

Canadians can minimize taxes legally. However, some schemes attract CRA scrutiny and penalties. The key difference lies in a transaction’s genuine economic purpose.

When arrangements seem artificial, tax authorities may challenge them. They use powerful legislative tools to do so.

Common Tax Shelter Schemes in Canada

Tax shelters promise deductions or credits exceeding the investment amount. The Income Tax Act penalizes those who provide incorrect tax shelter identification numbers.

Charity Donation Arrangements

These schemes involve inflated donation receipts. You might contribute $1,000 but receive a $5,000 tax receipt.

- Promises of tax receipts worth multiple times your actual donation

- Complex structures involving offshore entities

- Limited or no actual charitable work being performed

Business Loss Arrangements

These schemes create fake business losses to claim against regular income. They often involve:

- Limited partnerships with inflated expenses

- Transactions with no reasonable expectation of profit

- Circular financing arrangements with little economic risk

General Anti-Avoidance Rule (GAAR) Applications

The GAAR is the CRA’s strongest weapon against tax avoidance schemes. It can deny benefits from transactions that follow tax laws but violate their spirit.

“The GAAR draws a line between legitimate tax minimization and abusive tax avoidance, though exactly where that line should be drawn is often a matter of debate.”

Recent GAAR Jurisprudence

Canadian courts have refined GAAR application through key cases. Supreme Court decisions have clarified when transactions become abusive avoidance.

These rulings stress that transactions must have real economic substance beyond tax benefits. This is crucial to withstand GAAR scrutiny.

Penalties and Consequences for Income Tax Act Offences

Breaking Canada’s Income Tax Act leads to various penalties. These range from fines to criminal charges. The severity depends on the offense committed.

Consequences can affect both personal and professional life. They are designed to address non-compliance appropriately.

Administrative Monetary Penalties

The Canada Revenue Agency can impose administrative penalties directly. These don’t require court proceedings. They apply to various compliance failures.

Gross Negligence Penalties

The CRA can penalize false statements or omissions due to gross negligence. Penalties can reach 50% of understated tax or overstated credits.

The CRA must prove you acted knowingly or recklessly. This differs from regular penalties.

Late Filing and Payment Penalties

Filing late incurs a 5% penalty on unpaid tax. An additional 1% is added monthly, up to 12 months.

These penalties add to daily interest charges. This creates a quickly growing debt.

Criminal Prosecution and Potential Imprisonment

Serious tax offenses can lead to criminal charges. These fall under section 239 of the Income Tax Act.

Tax evasion convictions include paying all taxes owed plus interest. Civil penalties can reach 200% of taxes evaded. Imprisonment for up to five years is possible.

Tax fraud convictions are even more severe. Prison sentences can reach 14 years. Other consequences include fingerprinting and travel restrictions.

Sentencing Trends in Canadian Courts

Canadian judges are more likely to impose jail time for major tax offenses. Sentencing factors include the amount evaded and duration of non-compliance.

They also consider if the offense involved complex planning. Obstructing CRA investigations is another factor.

Professional and Reputational Damage

Tax offenses can ruin your professional standing. Regulated professionals may face disciplinary action. They could lose their licenses to practice.

Public disclosure of tax convictions causes lasting harm. This damage can be impossible to fully repair.

Long-term Impact on Business Operations

Businesses with tax convictions often struggle financially. They may have trouble securing loans, government contracts, or business licenses.

Many institutions conduct background checks that flag tax issues. This creates barriers to growth and partnerships for years.

These consequences show why tax compliance is crucial. It’s essential for both individuals and businesses in Canada.

CRA Investigation Process and Taxpayer Rights

CRA investigations require knowledge of the process and legal protections for Canadian taxpayers. The nature of their inquiry determines your rights and procedures. Understanding these distinctions can impact your response to CRA scrutiny.

Audit vs. Criminal Investigation Procedures

The CRA conducts two types of inquiries: civil audits and criminal investigations. Each follows distinct protocols with different implications for taxpayers.

Civil audits verify the accuracy of your tax filings. CRA officials examine your financial records to ensure compliance with tax laws. You must cooperate and provide assistance to auditors.

Criminal investigations gather evidence of potential Income Tax Act offences such as tax evasion. Specialized CRA investigators operate under stricter legal constraints than auditors.

| Aspect | Civil Audit | Criminal Investigation |

|---|---|---|

| Primary Purpose | Verify tax compliance | Gather evidence of tax offences |

| Legal Standard | Balance of probabilities | Beyond reasonable doubt |

| Taxpayer Obligations | Must cooperate and provide information | Right to remain silent |

| Potential Outcome | Reassessments and civil penalties | Criminal charges and potential imprisonment |

When Civil Audits Become Criminal Matters

A routine audit can become a criminal investigation if evidence suggests deliberate non-compliance. Warning signs include involvement of special investigators and detailed questions about specific transactions.

The CRA must inform you if they shift from a civil audit to a criminal investigation. They must also advise you of your rights.

Legal Protections During Tax Investigations

Canadian taxpayers have important legal protections when facing CRA scrutiny. These safeguards are especially significant during criminal investigations.

Charter Rights in Tax Enforcement

The Canadian Charter of Rights and Freedoms protects you during criminal tax investigations. You have the right to be free from unreasonable search and seizure.

You also have the right to remain silent and the right to counsel. These protections don’t apply as strongly during civil audits.

Solicitor-Client Privilege Considerations

Communications between you and your lawyer about tax matters are protected by solicitor-client privilege. The CRA cannot compel disclosure of these confidential discussions.

This privilege doesn’t extend to communications with your accountant unless they’re acting as your lawyer’s agent. Consider involving a tax lawyer early to establish privilege over key communications.

Compliance Strategies to Avoid Tax Offences

Proactive compliance strategies help Canadian taxpayers avoid Income Tax Act violations. Sound practices can reduce your risk of penalties or prosecution. These strategies are crucial for maintaining tax compliance.

Proper Record-Keeping Practices

Accurate and complete financial records are your first defense against tax problems. Good documentation supports your income sources, business expenses, and claimed deductions. This helps if the CRA questions your returns.

Business owners should keep detailed records of all transactions. This includes receipts, invoices, bank statements, and contracts. Individuals need T4 slips, charitable donation receipts, and medical expense records.

Documentation Retention Requirements

Canadian tax law specifies how long to keep various financial records:

| Document Type | Retention Period | Format Options | Special Considerations |

|---|---|---|---|

| General tax records | 6 years | Paper or electronic | Begins after the end of the tax year |

| Property records | 6 years after disposal | Paper or electronic | Includes purchase documents and improvement costs |

| Corporate records | 6 years after dissolution | Paper or electronic | Includes minute books and shareholder information |

| Electronic records | 6 years | Readable format | Must remain accessible and unaltered |

Working with Qualified Tax Professionals

Tax laws are complex and always changing. Qualified tax pros can help you follow rules and avoid common mistakes. They can prevent failure to file taxes and other violations.

Choose your tax advisor carefully. Check their credentials and experience with your tax situation. Be cautious of advisors promising huge refunds or promoting aggressive tax avoidance schemes.

Ask about their audit experience and approach to unclear tax laws. Good professionals focus on compliance, not risky tax positions.

Voluntary Disclosures Program

The CRA’s Voluntary Disclosures Program (VDP) helps fix past tax mistakes. You can correct your tax affairs without facing full penalties.

Relief Provisions and Limitations

The VDP offers relief from prosecution and penalties for voluntary disclosures. Recent changes limit eligibility for major non-compliance cases. Act fast, as VDP protection ends once the CRA starts an audit.

To qualify, your disclosure must be complete and involve a penalty. It should include overdue information and estimated tax payment. The program is not available after CRA contact.

Conclusion

Every Canadian taxpayer must grasp Income Tax Act offences. Our tax system funds crucial services like healthcare and education. Your compliance matters both legally and socially.

You have the right to plan your taxes. But tax evasion has serious consequences. The CRA uses advanced tech to catch non-compliance.

Income Tax Act offences can lead to more than just fines. Criminal charges and jail time are possible. Your professional reputation could suffer lasting damage.

To protect yourself, keep detailed records. Consult tax experts when needed. Consider the Voluntary Disclosures Program for past mistakes.

Proper tax compliance isn’t just about avoiding penalties. It’s about supporting the services that make Canada great. Your choice reflects your civic duty.

Understanding tax law helps you manage your finances well. It also supports public services that benefit everyone. Make the right choice for yourself and your country.